Reddit group thwarts Wall Street giants in stock battle

GameStop investors nationwide have likely profited off of the fight for their stocks.

How did a failing publicly-traded company on the verge of bankruptcy have their stock increase astronomically in such a short amount of time? Well, it was the work of a large group of determined individuals on the website Reddit. The stock rose from $35 on January 19 to $347 by January 27. Their collective effort was not for a joke, though—they were taking a stand against the rich and powerful on Wall Street.

GameStop is a video game company that specializes in selling video games and consoles. They were the go-to place for games from the 90s until the mid 2010s. The problem for the company arose when physical game cartridges and discs lost their popularity and people began buying their games digitally for convenience. This made the company continue to do worse as the years progressed. Their inability to adapt to modern times is the reason for their failure, and investors saw an opportunity to take advantage of the cheap stock prices using hedge funds. Hedge funds are pools of invested money by different people, which then allows those who put their money into it to diversify their investment portfolio. One technique that hedge funds use is called short selling. This is when the investor borrows a stock from a broker, sells the stock that they borrowed, buys that stock again knowing that it is at a cheaper price, and then returns the stock to the broker, thus leaving the investor with the profits. The hedge funds saw that GameStop was on its way to failing so they were ready to short sell the stock. This would be a smart move and an easy profit for those involved with the hedge fund, but recently, something unexpected occurred.

r/wallstreetbets is a subreddit on the community networking site Reddit that focuses on stocks and trading on the stock market. It was never known as a place to get serious information on stocks and was more of a lighthearted subreddit with a focus on financial memes. When the GameStop stock began to fall, posters on the subreddit made the prediction that hedge funds were going to short sell the stock. With this in mind, they decided to work together and buy as much of the stock as they possibly could. This was done so that the hedge funds who sold the borrowed stock would not be able to buy it back at a profit and would lose a lot of money. The reason they decided to do this was because the hedge funds are owned by wealthy investors on Wall Street that benefit from unemployment and the decline of companies—a practice that, while legal, many find ethically questionable at best and exploitative at worst.

The members of r/wallstreetbets used their voice to get as many people as possible to buy GameStop stock leading it to go viral and spread throughout the internet. Investors everywhere were buying the stock leading to a 900 percent increase. There were stories of people being able to pay their college tuition, donate large amounts to charity and even become millionaires. Everyone wanted to get into the GameStop craze and it only increased the hype of the stock.

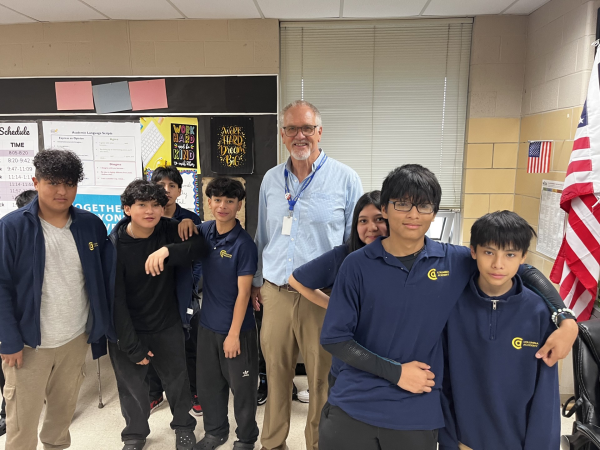

Students in Columbia Heights High School were also able to join in on buying the stock.

“I found the GameStop stock trending on Twitter and have always wanted to get into investing since I turned 18,” Blong Lor (12) said. “I only invested a little amount and made little return on my investment because I was too scared to lose any money but it was fun to be a part of the experience.”

With the huge increase in people buying stock, investing apps like Robinhood were being downloaded and used at an all time high. Confusingly, Robinhood decided to shut down the ability to buy GameStop and another company trending on the subreddit, the movie theater chain AMC, leading to outrage from the people. This looked to be market manipulation as locking these stocks from people would be helping the hedge funds. Robinhood CEO Vlad Tenev went on CNBC to explain what occurred.

“We absolutely did not do this at the direction of any market maker or hedge fund or anyone we route to,” Tenev said dispelling the rumors of manipulation. “The reason we did it was because Robinhood is a brokerage firm and we have lots of financial requirements.”

By the time the stocks opened up again for GameStop the hype already began to die and investors were selling their stock before they lost all their money. Although the plan by r/wallstreetbets came to a swift end, they inarguably proved to the millionaires, billionaires and elites that the common people do have a voice and that if they put their efforts together, they can do anything.

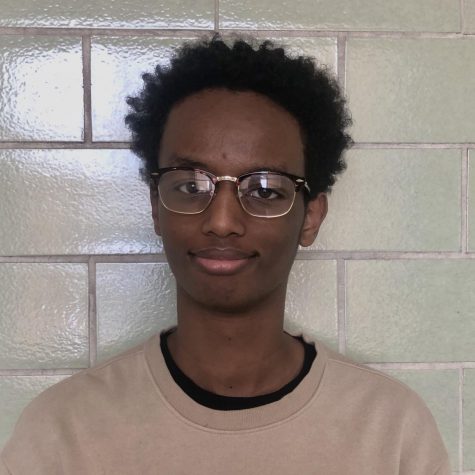

Fuad Hassan is in 12th grade and he is Sports Editor for the Heights Herald. He is on the track team and is a member of knowledge bowl. Fuad enjoys...

Rae Lawrence is a senior this year at Columbia Heights High School. This is her third year on The Heights Herald, this time serving as Co-Editor-in-Chief...